An unprecedented number of events have been cancelled or postponed in recent weeks due to…

Setting Sail to Financial Success: Navigating Your Association’s Financial Priorities

In the ever-evolving landscape of associations, financial stability is the North Star that guides every decision, every initiative, and every leap forward. As association leaders, it’s crucial to chart a course that not only addresses the present financial needs but also sets sail toward a prosperous future. To do that, it’s essential to answer a fundamental question: What are your association’s financial priorities going forward?

To gain a better understanding of the financial compass of associations, we looked at our most recent OAX (OTUS Association Exchange) survey, and the responses were insightful. Here’s what we found:

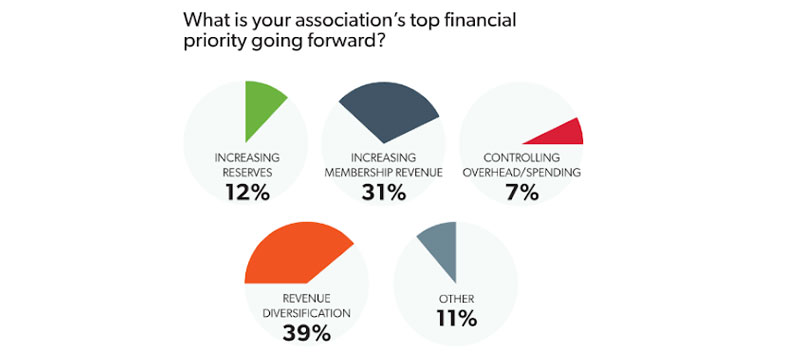

What is your association’s top financial priority going forward?

Increasing Reserves (12%): For some associations, the journey toward financial stability involves bolstering their reserves. It’s like adding an extra layer of armor to weather any unforeseen storms. Increasing reserves is an essential financial priority that offers peace of mind and the ability to seize opportunities without hesitation.

Increasing Membership Revenue (31%): Associations thrive on the strength of their membership. Increasing membership revenue is a prominent goal for many, and rightfully so. A growing membership base not only ensures financial stability but also expands your reach and influence.

Controlling Overhead/Spending (7%): Prudent financial management is the cornerstone of a stable association. Controlling overhead and spending ensures that resources are used efficiently and effectively. While it may not be the most glamorous priority, it’s undeniably vital.

Revenue Diversification (39%): The saying “Don’t put all your eggs in one basket” holds true for associations as well. Revenue diversification is a top priority for a significant number of associations. It involves exploring new revenue streams, partnerships, and innovative fundraising methods to reduce reliance on a single source of income.

Other (11%): Associations are as diverse as the industries and professions they represent. Some have unique financial priorities that can’t be neatly categorized into the above four options. These could include specific projects, investments, or challenges unique to their circumstances.

So, what does this data tell us? It tells us that the financial priorities of associations are as diverse as the associations themselves. There’s no one-size-fits-all answer, and that’s perfectly okay. Each association must navigate its financial journey based on its mission, goals, and the environment it operates in.

Here are a few key takeaways to consider:

- Tailor Your Financial Strategy: Your association’s financial strategy should align with its unique priorities. Whether it’s building reserves, boosting membership revenue, or diversifying income, customize your approach.

- Embrace Diversity: Revenue diversification is a smart move. Explore new opportunities and partnerships to reduce financial risks and seize untapped potential. Consider whether there are additional services, products, or events that could appeal to your members or target audience.

- Be Mindful of Spending: Controlling overhead and spending is always important. Efficient resource management can free up funds for growth and innovation. Consider negotiating contracts with vendors to secure more favorable terms or seek competitive bids. Embracing technology solutions that can streamline operations and reduce administrative costs can save time and money

- Adapt to Change: Remember that financial priorities can evolve. Stay agile and be ready to adjust your strategy as circumstances change. Your association’s members and stakeholders are invaluable sources of insight – Regularly engage with them through surveys, focus groups, or feedback sessions to understand their evolving needs and expectations.

- Seek Expert Advice: If you’re unsure about the best way forward for your association, don’t hesitate to seek expert financial advice. Financial experts at OTUS Group can guide your way forward. We’ll work collaboratively to chart the most beneficial course for your association, ensuring you reach your ultimate destination with confidence and precision. If you’d like to learn more please reach out here.

In conclusion, the financial future of your association is a journey that requires careful planning, flexibility, and a clear understanding of your unique priorities. By identifying and pursuing your top financial priority, you’ll set your association on a course for financial success, ensuring it continues to thrive and serve its members effectively in the years to come. Bon voyage!